Amur Capital Management Corporation - Questions

Amur Capital Management Corporation - Questions

Blog Article

Amur Capital Management Corporation - Truths

Table of ContentsMore About Amur Capital Management CorporationFascination About Amur Capital Management CorporationThe smart Trick of Amur Capital Management Corporation That Nobody is DiscussingNot known Details About Amur Capital Management Corporation Some Known Incorrect Statements About Amur Capital Management Corporation All About Amur Capital Management CorporationWhat Does Amur Capital Management Corporation Do?

A low P/E proportion may indicate that a company is undervalued, or that financiers expect the business to deal with harder times in advance. What is the excellent P/E proportion? There's no ideal number. Financiers can make use of the typical P/E proportion of various other business in the same industry to create a standard - investing for beginners in copyright.

Amur Capital Management Corporation Can Be Fun For Anyone

The standard in the vehicle and truck market is just 15. A stock's P/E proportion is very easy to discover on the majority of economic reporting internet sites. This number indicates the volatility of a supply in comparison to the market in its entirety. A protection with a beta of 1 will certainly display volatility that's similar to that of the marketplace.

A stock with a beta of above 1 is in theory more volatile than the market. For instance, a safety and security with a beta of 1.3 is 30% even more volatile than the market. If the S&P 500 increases 5%, a stock with a beta of 1. https://www.behance.net/christobaker32.3 can be anticipated to increase by 8%

Amur Capital Management Corporation Can Be Fun For Everyone

EPS is a buck number standing for the section of a business's revenues, after taxes and favored stock rewards, that is designated per share of typical stock. Investors can utilize this number to evaluate just how well a firm can supply worth to shareholders. A greater EPS begets greater share costs.

If a company on a regular basis fails to supply on profits projections, an investor may desire to reconsider acquiring the supply - alternative investment. The computation is simple. If a business has an internet income of $40 million and pays $4 million in returns, after that the continuing to be amount of $36 million is separated by the number of shares outstanding

5 Easy Facts About Amur Capital Management Corporation Described

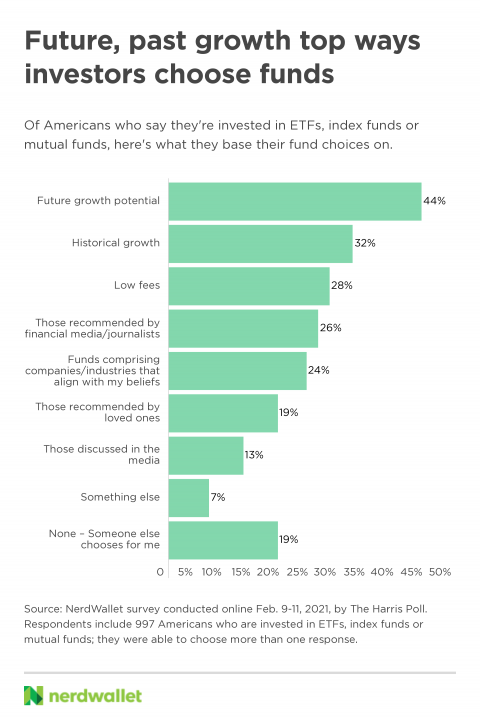

Financiers typically obtain thinking about a stock after reading headlines about its extraordinary performance. Just remember, that's the other day's information. Or, as the spending pamphlets constantly expression it, "Previous efficiency is not a forecaster of future returns." Audio investing choices must consider context. A consider the pattern in rates over the previous 52 weeks at the least is essential to obtain a feeling of where a supply's cost may go next.

Allow's look at what these terms mean, how they vary and which one is best for the ordinary financier. Technical analysts read the full info here comb via huge volumes of information in an initiative to anticipate the direction of stock prices. The information consists mostly of past rates info and trading volume. Basic evaluation fits the requirements of most investors and has the advantage of making great sense in the genuine globe.

They think costs adhere to a pattern, and if they can understand the pattern they can maximize it with well-timed professions. In current decades, innovation has allowed more financiers to exercise this design of investing due to the fact that the tools and the information are more obtainable than ever. Essential analysts take into consideration the innate value of a stock.

Little Known Facts About Amur Capital Management Corporation.

Technical evaluation is finest matched to a person who has the time and convenience level with data to place infinite numbers to use. Over a duration of 20 years, annual costs of 0.50% on a $100,000 investment will certainly decrease the portfolio's worth by $10,000. Over the exact same duration, a 1% cost will decrease the very same portfolio by $30,000.

The trend is with you (https://www.kickstarter.com/profile/amurcapitalmc/about). Take advantage of the trend and store around for the cheapest expense.

Some Known Factual Statements About Amur Capital Management Corporation

, environment-friendly area, beautiful sights, and the community's standing element plainly into residential home valuations. A vital when taking into consideration home area is the mid-to-long-term view regarding exactly how the location is anticipated to develop over the investment duration.

What Does Amur Capital Management Corporation Do?

Extensively evaluate the ownership and desired usage of the instant areas where you prepare to spend. One means to collect information concerning the prospects of the vicinity of the home you are taking into consideration is to contact the city center or various other public agencies accountable of zoning and urban planning.

This supplies regular earnings and long-term value admiration. This is typically for fast, small to medium profitthe normal building is under building and marketed at an earnings on conclusion.

Report this page